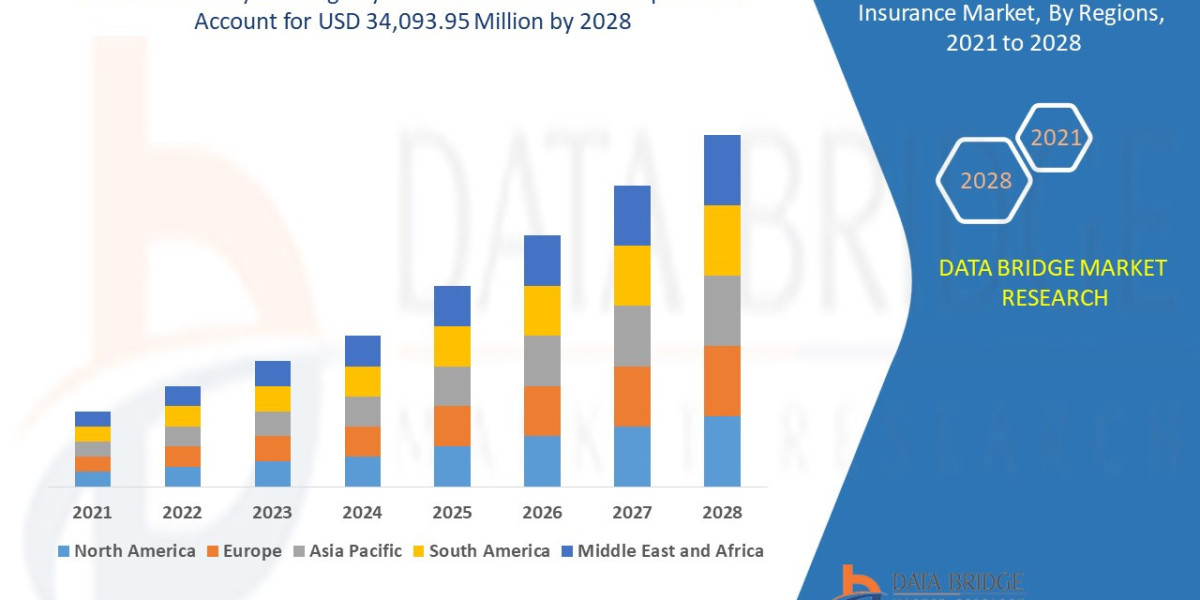

"The First Party Coverage Cyber Insurance Market sector is undergoing rapid transformation, with significant growth and innovations expected by 2028. In-depth market research offers a thorough analysis of market size, share, and emerging trends, providing essential insights into its expansion potential. The report explores market segmentation and definitions, emphasizing key components and growth drivers. Through the use of SWOT and PESTEL analyses, it evaluates the sector’s strengths, weaknesses, opportunities, and threats, while considering political, economic, social, technological, environmental, and legal influences. Expert evaluations of competitor strategies and recent developments shed light on geographical trends and forecast the market’s future direction, creating a solid framework for strategic planning and investment decisions.

Brief Overview of the First Party Coverage Cyber Insurance Market:

The global First Party Coverage Cyber Insurance Market is expected to experience substantial growth between 2024 and 2031. Starting from a steady growth rate in 2023, the market is anticipated to accelerate due to increasing strategic initiatives by key market players throughout the forecast period.

Get a Sample PDF of Report - https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-first-party-coverage-cyber-insurance-market

Which are the top companies operating in the First Party Coverage Cyber Insurance Market?

The report profiles noticeable organizations working in the water purifier showcase and the triumphant methodologies received by them. It likewise reveals insights about the share held by each organization and their contribution to the market's extension. This Global First Party Coverage Cyber Insurance Market report provides the information of the Top Companies in First Party Coverage Cyber Insurance Market in the market their business strategy, financial situation etc.

BitSight Technologies.; TAG CYBER AND REDSEAL; SecurityScorecard; Cyber Indemnity Solutions Ltd; Cisco; UpGuard, Inc.; Microsoft; Check Point Software Technologies Ltd.; AttackIQ.; SentinelOne; Symantec Corporation.; Accenture.; Kenna Security.; FireEye, Inc.; CyberArk Software Ltd.; Foundershield LLC; Chubb; AXA XL; American International Group, Inc.; The Travelers Indemnity Company

Report Scope and Market Segmentation

Which are the driving factors of the First Party Coverage Cyber Insurance Market?

The driving factors of the First Party Coverage Cyber Insurance Market are multifaceted and crucial for its growth and development. Technological advancements play a significant role by enhancing product efficiency, reducing costs, and introducing innovative features that cater to evolving consumer demands. Rising consumer interest and demand for keyword-related products and services further fuel market expansion. Favorable economic conditions, including increased disposable incomes, enable higher consumer spending, which benefits the market. Supportive regulatory environments, with policies that provide incentives and subsidies, also encourage growth, while globalization opens new opportunities by expanding market reach and international trade.

First Party Coverage Cyber Insurance Market - Competitive and Segmentation Analysis:

**Segments**

- **Insurance Type**: The market can be segmented based on insurance type into standalone cyber insurance, packaged cyber insurance, and personal cyber insurance. Standalone cyber insurance offers coverage solely for cyber risks, while packaged cyber insurance is bundled with other traditional insurance products. Personal cyber insurance caters to individuals seeking protection for their personal cyber activities.

- **Coverage Type**: On the basis of coverage type, the market can be categorized into first party coverage and third party coverage. First party coverage includes reimbursement for losses incurred directly by the policyholder due to cyber events, such as data breaches or ransomware attacks. On the other hand, third party coverage involves indemnification for liabilities arising from claims by third parties affected by a cyber incident.

- **End-User**: This segment can be segmented by end-users such as large enterprises, small and medium-sized enterprises (SMEs), and individuals. Large enterprises may require comprehensive cyber insurance solutions to protect their extensive digital assets, while SMEs and individuals may opt for tailored coverage suited to their specific needs and budgets.

**Market Players**

- **Chubb Limited**: Chubb Limited is a prominent player in the global first-party coverage cyber insurance market, offering a range of cyber insurance solutions that address the evolving cyber risks faced by businesses. The company's comprehensive coverage options and risk management services distinguish it as a trusted provider in the industry.

- **American International Group, Inc. (AIG)**: AIG is another key market player that provides first-party coverage cyber insurance to businesses worldwide. With a focus on innovative risk mitigation strategies and tailored insurance products, AIG remains at the forefront of the cyber insurance market, catering to the diverse needs of its clientele.

- **AXA**: AXA is a leading insurance provider that offers first-party coverage cyber insurance to organizations seeking robust protection against cyber threats. The company's emphasis on proactive risk assessment and customized insurance solutions has solidified its position as a preferred partner for businesses navigating the complexities of the digital landscape.

In conclusion, the global first-party coverage cyber insurance market is witnessing significant growth due to the escalating threat landscape and the increasing awareness of cybersecurity risks among businesses and individuals. The segmentation based on insurance type, coverage type, and end-users highlights the diverse needs driving market demand. Key market players such as Chubb Limited, AIG, and AXA are playing a crucial role in shaping the market landscape with their innovative insurance offerings and risk management services. As the cyber insurance market continues to evolve, strategic partnerships and technological advancements will be instrumental in meeting the ever-changing needs of policyholders.

https://www.databridgemarketresearch.com/reports/global-first-party-coverage-cyber-insurance-marketThe global first-party coverage cyber insurance market is experiencing a paradigm shift driven by the evolving landscape of cyber threats and the growing recognition of cybersecurity vulnerabilities across various industries. One emerging trend in the market is the increasing demand for tailored cyber insurance solutions that cater to specific industry requirements and risk profiles. Industries such as healthcare, finance, and technology are particularly prioritizing cyber insurance as a critical component of their risk management strategies. This trend underscores the importance of customization and specialization in the cyber insurance market to address the unique challenges faced by different sectors.

Another notable development in the market is the emphasis on proactive risk assessment and continuous monitoring services offered by leading insurance providers. Insurers are increasingly leveraging advanced analytics, artificial intelligence, and machine learning technologies to assess cyber risks, identify vulnerabilities, and recommend preventive measures to policyholders. This proactive approach not only enhances the effectiveness of cyber insurance coverage but also establishes insurers as strategic risk management partners for businesses looking to fortify their cybersecurity posture.

Moreover, the integration of cyber insurance with broader enterprise risk management frameworks is becoming a prevalent practice among organizations seeking comprehensive protection against cyber threats. By aligning cyber insurance coverage with overall risk mitigation strategies, businesses can achieve a more holistic approach to managing cybersecurity risks and minimizing potential financial losses in the event of a cyber incident. This integrated risk management approach is driving the convergence of cyber insurance with other lines of insurance, such as property and casualty, to provide seamless coverage for comprehensive risk protection.

Furthermore, the growing emphasis on regulatory compliance and data privacy regulations is shaping the dynamics of the cyber insurance market, with insurers offering specialized coverage options to help businesses navigate the complex regulatory environment. The convergence of cybersecurity regulations, such as GDPR and CCPA, with cyber insurance requirements is prompting insurers to develop policies that address specific compliance needs and mitigate legal exposures arising from data breaches and non-compliance issues. This alignment of regulatory compliance with cyber insurance coverage is essential for businesses operating in highly regulated sectors and jurisdictions, emphasizing the importance of regulatory risk management in the cyber insurance market.

In conclusion, the evolving trends in the global first-party coverage cyber insurance market reflect a shifting landscape characterized by customization, proactive risk assessment, integrated risk management, and regulatory alignment. As businesses continue to prioritize cybersecurity and risk resilience, the demand for innovative cyber insurance solutions tailored to industry-specific needs will drive market growth and differentiation among market players. By staying abreast of emerging trends and aligning their offerings with evolving risk profiles, insurers can position themselves as trusted partners in safeguarding businesses against the ever-evolving cyber threats landscape.**Segments**

Global First Party Coverage Cyber Insurance Market, By Component: The market is segmented into solutions and services, offering a range of comprehensive cyber insurance products and risk management services catering to the evolving needs of businesses in the digital landscape.

Insurance Coverage: The market offers coverage for data breaches and cyber liability, ensuring that policyholders are protected against financial losses and liabilities arising from cyber incidents.

Insurance Type: Included are packaged and standalone cyber insurance options, providing businesses with flexibility in choosing the type of coverage that aligns with their risk profiles and requirements.

Organization Size: The market caters to large enterprises and small and medium-sized enterprises, offering tailored cyber insurance solutions to meet the distinctive needs of businesses based on their size and digital assets.

End User: Technology providers and insurance providers have access to cyber insurance solutions tailored to their specific industry requirements and cybersecurity challenges, ensuring comprehensive protection against cyber threats.

Coverage Type: This segment encompasses theft and fraud, computer program and electronic restoration, extortion, forensic investigation, and business interruption coverage, providing a broad range of protection against various cyber risks.

Country: The market spans across regions, including the U.S., Canada, Mexico, Brazil, Argentina, Europe, Asia-Pacific, Middle East, and Africa, offering global coverage and support for businesses operating in diverse geographical locations.

Industry Trends and Forecast to 2028:

- Increasing demand for tailored cyber insurance solutions

- Emphasis on proactive risk assessment and monitoring services

- Integration of cyber insurance with enterprise risk management frameworks

- Growing focus on regulatory compliance and data privacy regulations

**Market Players**

- BitSight Technologies

- TAG CYBER AND REDSEAL

- SecurityScorecard

- Cyber Indemnity Solutions Ltd

- Cisco

- UpGuard, Inc.

- Microsoft

- Check Point Software Technologies Ltd.

- AttackIQ

- SentinelOne

- Symantec Corporation

- Accenture

- Kenna Security

- FireEye, Inc.

- CyberArk Software Ltd

- Foundershield LLC

- Chubb

- AXA XL

- American International Group, Inc.

- The Travelers Indemnity Company

These market players are actively contributing to the growth and development of the global first-party coverage cyber insurance market by offering innovative insurance solutions, risk management services, and tailored coverage options to meet the evolving cybersecurity needs of businesses worldwide. Their presence in the market signifies a commitment to addressing the complex challenges posed by cyber threats and ensuring robust protection for policyholders against the ever-changing cyber risk landscape.

North America, particularly the United States, will continue to exert significant influence that cannot be overlooked. Any shifts in the United States could impact the development trajectory of the First Party Coverage Cyber Insurance Market. The North American market is poised for substantial growth over the forecast period. The region benefits from widespread adoption of advanced technologies and the presence of major industry players, creating abundant growth opportunities.

Similarly, Europe plays a crucial role in the global First Party Coverage Cyber Insurance Market, expected to exhibit impressive growth in CAGR from 2024 to 2028.

Explore Further Details about This Research First Party Coverage Cyber Insurance Market Report https://www.databridgemarketresearch.com/reports/global-first-party-coverage-cyber-insurance-market

Key Benefits for Industry Participants and Stakeholders: –

- Industry drivers, trends, restraints, and opportunities are covered in the study.

- Neutral perspective on the First Party Coverage Cyber Insurance Market scenario

- Recent industry growth and new developments

- Competitive landscape and strategies of key companies

- The Historical, current, and estimated First Party Coverage Cyber Insurance Market size in terms of value and size

- In-depth, comprehensive analysis and forecasting of the First Party Coverage Cyber Insurance Market

Geographically, the detailed analysis of consumption, revenue, market share and growth rate, historical data and forecast (2024-2031) of the following regions are covered in Chapters

The countries covered in the First Party Coverage Cyber Insurance Market report are U.S., Canada and Mexico in North America, Brazil, Argentina and Rest of South America as part of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA

Detailed TOC of First Party Coverage Cyber Insurance Market Insights and Forecast to 2028

Part 01: Executive Summary

Part 02: Scope Of The Report

Part 03: Research Methodology

Part 04: First Party Coverage Cyber Insurance Market Landscape

Part 05: Pipeline Analysis

Part 06: First Party Coverage Cyber Insurance Market Sizing

Part 07: Five Forces Analysis

Part 08: First Party Coverage Cyber Insurance Market Segmentation

Part 09: Customer Landscape

Part 10: Regional Landscape

Part 11: Decision Framework

Part 12: Drivers And Challenges

Part 13: First Party Coverage Cyber Insurance Market Trends

Part 14: Vendor Landscape

Part 15: Vendor Analysis

Part 16: Appendix

Browse More Reports:

Portuguese: https://www.databridgemarketresearch.com/pt/reports/global-first-party-coverage-cyber-insurance-market

Data Bridge Market Research:

Today's trends are a great way to predict future events!

Data Bridge Market Research is a market research and consulting company that stands out for its innovative and distinctive approach, as well as its unmatched resilience and integrated methods. We are dedicated to identifying the best market opportunities, and providing insightful information that will help your business thrive in the marketplace. Data Bridge offers tailored solutions to complex business challenges. This facilitates a smooth decision-making process. Data Bridge was founded in Pune in 2015. It is the product of deep wisdom and experience.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC: +653 1251 999